Share on social

The Hidden Costs of Financial Stress in the Workplace

Thursday 20 June 2024

By Janine Cunningham | Operations Director at IQ&Co.

By Janine Cunningham | Operations Director at IQ&Co.In today's fast-paced world, where financial concerns are ever-looming, the impact of money worries on workplace productivity and employee well-being cannot be overstated. Recent research sheds light on the staggering statistics surrounding financial stress in the workplace and its detrimental effects on both individuals and organisations.

Money Worries on the Rise:

According to recent studies, a 24% of UK employees grapple with money worries daily, with a notable 8% increase in the past year alone . Research reveals a concerning trend of rising financial stress among employees, with significant impacts on productivity, mental health, and overall job satisfaction.

Financial Pressure and Productivity:

The correlation between financial pressure and productivity loss is undeniable. Reports indicate that nearly a third of workers experience a drop in productivity ranging from 1 to 2 hours per day due to financial distress .

Over the past two years, approximately 4.9 million private sector workers have seen a decline in productivity attributable to financial concerns. Such a decline not only affects individual performance but also takes a toll on organisational efficiency and success.

The Call for Employer Support:

Despite the prevalence of financial stress, a significant gap exists in employer-provided support. Research reveals that a staggering 63% of employees desire more assistance with their finances from their employers, yet only a mere 11% have received financial education in the past year. This disparity underscores the urgent need for employers to prioritise financial well-being initiatives within the workplace.

Impact on the Organisational Bottom Line:

The consequences of neglecting financial well-being initiatives extend beyond individual employees to affect the overall bottom line of organisations.

• 13 million days of work were lost as a result of 2.5 million private sector workers taking time off in the last year due to poor financial wellbeing

• £192 per day is the average cost to employers for each day lost due to financial distress.

• 2.5 Billion is the total cost of absenteeism to UK employers due to poor financial wellbeing.

These figures underscore the financial burden placed on organisations by overlooking the importance of addressing financial stress among their workforce.

Our Solution

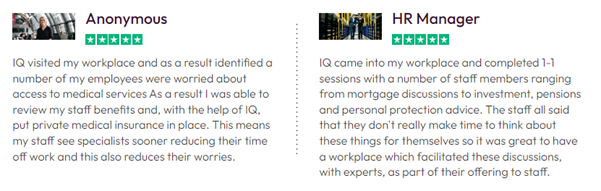

We at IQ&Co have recognised these trends and understand that money and mental health are invariably linked. Which is why we have devised a program, for employers to avail of, offering free Financial Wellbeing Events and workshops to support employees. Each session is specifically tailored to the needs and concerns of staff, whatever life stage they’re at.

What is a Financial Wellbeing event?

A Financial Wellbeing event is a holistic program aimed at equipping employees with the knowledge, skills, and support necessary to navigate their financial journey with confidence. Through a combination of workshops, personalised guidance sessions, and access to expert advice, employees will have the opportunity to address their unique financial challenges and goals in a supportive and confidential environment.

Our Approach to Financial Wellbeing events has 4 steps:

1. Assessment: We will assess employee demographics, age ranges, life stages, current benefit packages, working closely with you HR representative and the business owner.

2. Offering: We will tailor our offering to suit your business needs.

3. Program delivery: We Use our industry knowledge and expertise to deliver the program.

4. Support: We provide ongoing support for staff members and for the business owner.

Our offering can come in many forms, depending on what is right for you and your business and can include:

1. Generic Workshops: We have a series of sessions that can be delivered either in-person or virtually to your employees. Although generic enough to present to a group, they aim to be accessible and relevant.

2. Bespoke Workshops: Tailored workshops will cover a range of topics, including budgeting, saving strategies, debt management, investments, retirement planning, and more. These sessions will be led by our financial experts who will provide practical insights and actionable advice to help employees make informed financial decisions.

3. 1:1 Guidance Sessions: Personalised guidance sessions offer employees the opportunity to receive individualised support and advice tailored to their specific financial circumstances and goals. Whether seeking assistance with budgeting, debt consolidation, or long-term financial planning, employees will have access to experienced professionals who can provide personalised recommendations and strategies.

Ultimately any of the above offerings will give employees the opportunity to take advantage of a free initial meeting with a qualified Financial Adviser to discuss a specific need or to have a full financial health check covering areas including:

• Budget

• Their mortgage

• Protecting what's important

• Tax Planning

• Planning for retirement

• Wills and Power of Attorney

• Investment Planning

• A range of other services

Advantages for the employer

Implementing a staff financial wellbeing program can offer numerous advantages to employers. These programs can have a significant positive impact on both the employees and the organisation as a whole.

1. Increased Productivity

• Reduced Financial Stress: Financial worries can distract employees and reduce their focus and productivity at work. Providing support to manage their finances can help employees concentrate better on their job.

• Enhanced Focus and Efficiency: Employees who are less stressed about money are more likely to be engaged and efficient in their roles.

2. Improved Employee Engagement and Morale

• Increased Job Satisfaction: When employees feel that their employer cares about their financial wellbeing, job satisfaction and loyalty tend to increase.

• Positive Workplace Culture: Financial wellbeing programs can contribute to a more supportive and positive work environment, boosting overall morale.

3. Enhanced Recruitment and Retention

• Attractive Employer: Companies with comprehensive financial wellbeing programs are more attractive to potential employees, making it easier to attract top talent.

• Employee Retention: Employees are more likely to stay with an employer that helps them manage their financial health, reducing turnover rates and associated recruitment costs.

4. Cost Savings

• Reduced Absenteeism: Financial stress can lead to absenteeism as employees may need to take time off to deal with financial issues. Helping employees manage their finances can reduce these instances.

• Decreased Turnover Costs: Lower turnover rates mean reduced costs related to hiring and training new employees.

5. Better Mental Health

• Stress Reduction: Financial worries are a major source of stress. Financial wellbeing programs that include financial planning, debt management, and investment advice can help reduce this stress.

• Enhanced Resilience: Employees with better financial health are generally more resilient and capable of handling work-related challenges without being overwhelmed by personal financial issues.

6. Improved Financial Literacy

• Empowered Employees: Financial education programs can empower employees to make better financial decisions, leading to greater financial security and confidence.

• Long-Term Benefits: Educating employees about savings, investments, retirement planning, and debt management can have long-term benefits for their financial health.

7. Positive Organisational Reputation

• Corporate Social Responsibility: Companies that prioritise employee financial wellbeing can enhance their reputation as responsible and caring employers, positively impacting their brand and public image.

• Customer Perception: A financially secure and satisfied workforce can lead to better customer service, enhancing customer satisfaction and loyalty.

8. Overall Organisational Health

• Holistic Wellbeing: Financial wellbeing is a key component of overall employee wellbeing. Addressing financial health alongside physical and mental health can lead to a more holistic approach to employee wellness.

• Enhanced Employer-Employee Relationship: Demonstrating a commitment to employees' financial wellbeing can strengthen the relationship between employer and employees, fostering loyalty and a sense of community.

FINALLY…

Investing in a staff financial wellbeing program can lead to a more engaged, productive, and loyal workforce, which ultimately benefits the organisation's bottom line and long-term success. Financial wellbeing support in organisations can provide benefits not only for the employees but also the employer. By fostering financial security and literacy, organisations can enhance productivity, reduce stress, and create a more engaged and loyal workforce. The positive ripple effects of such programs extend beyond individual employees, contributing to a healthier, more innovative, and resilient organisation.

All of this is not even touching on the, often overlooked, needs of the business owner themselves. Effective planning is key, especially as business grows and the finances start to become increasingly complex with additional tax and protection needs arising.

To find out more or to implement a Financial Wellbeing Event in your workplace contact info@weareiq.com.

You can also join our upcoming Women in Business event on Wednesday 11th September | 17:30pm - 19:30pm at Glandore Belfast with IQ&Co - Thrive in Life: Building A Foundation For Financial & Personal Wellbeing. Register now.

1. Wagestream, The State of Financial Wellbeing, 2022

2. ONS, How are financial pressures affecting people in Great Britain? 2023 (sample size 18,464).

3. Cebr report for Aegon, Financial wellbeing and productivity in the workplace, Nov 2021

4. Cebr report for Aegon, Financial wellbeing and productivity in the workplace, Nov 2021

Thursday 20 June 2024

Contact us

Contact us

Share on social

Share on social Share with a friend

Share with a friend Facebook

Facebook LinkedIn

LinkedIn

Twitter

Twitter

Get in touch with us

Get in touch with us